Insurance is an essential part of our lives that helps protect us from financial losses resulting from unexpected events. It provides a safety net that helps us manage risks and recover from losses. However, despite its importance, many people don’t fully understand how insurance works or the different types of insurance available. In this article, we’ll cover the basics of insurance and help you understand how it can protect you and your loved ones.

Table of Contents

- Introduction

- What is Insurance?

- How Does Insurance Work?

- The Different Types of Insurance

- Life Insurance

- Health Insurance

- Auto Insurance

- Homeowners Insurance

- Disability Insurance

- Why Do You Need Insurance?

- How to Choose the Right Insurance Policy

- Common Insurance Terms You Should Know

- Deductible

- Premium

- Claim

- Underwriting

- Policy

- Common Insurance Myths Debunked

- Conclusion

- FAQs

1. Introduction

Insurance is a form of risk management that helps protect individuals and businesses from financial losses. The concept of insurance dates back thousands of years when traders would pool their resources together to protect themselves from losses resulting from theft or damage to their goods. Today, insurance has evolved into a sophisticated industry that provides coverage for a wide range of risks.

2. What is Insurance?

Insurance is a contract between an individual or a business and an insurance company. The individual or business agrees to pay a premium, and in exchange, the insurance company agrees to pay for certain losses or damages that may occur.

3. How Does Insurance Work?

Insurance works by pooling risks together. Insurance companies collect premiums from a large group of individuals or businesses and use the money to pay for losses or damages that may occur. The idea behind insurance is that not everyone will experience a loss or damage, so the money collected from those who don’t experience a loss or damage can be used to compensate those who do.

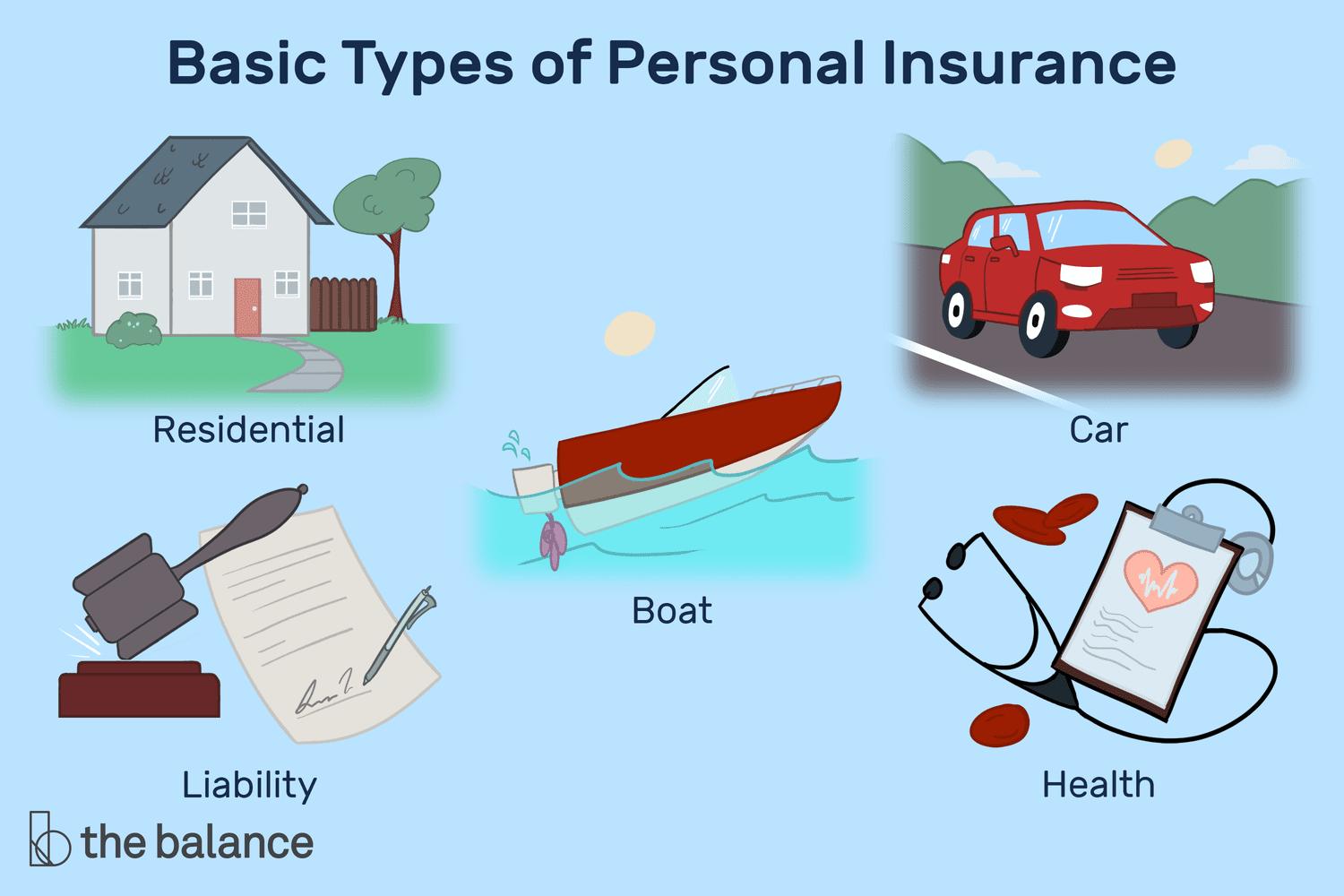

4. The Different Types of Insurance

There are several types of insurance available, each designed to protect against specific risks. Some of the most common types of insurance include:

4.1 Life Insurance

Life insurance provides financial protection to your loved ones in the event of your death. It pays out a lump sum to your beneficiaries, which can be used to pay for funeral expenses, pay off debts, or provide financial support.

4.2 Health Insurance

Health insurance helps pay for medical expenses, including doctor visits, hospital stays, and prescription drugs. It can be purchased individually or provided by an employer.

4.3 Auto Insurance

Auto insurance provides coverage for damage to your vehicle and liability for injuries and damages you may cause to others while driving. It’s required by law in most states.

4.4 Homeowners Insurance

Homeowners insurance provides coverage for damage to your home and personal property. It also provides liability coverage for injuries that may occur on your property.

4.5 Disability Insurance

Disability insurance provides income replacement in the event that you’re unable to work due to an injury or illness.

5. Why Do You Need Insurance?

Insurance is important because it helps protect you and your loved ones from financial losses resulting from unexpected events. Without insurance, you would be responsible for paying for any damages or losses out of your own pocket. Insurance provides a safety net that helps you manage risks and recover from losses.

6. How to Choose the Right Insurance Policy

Choosing the right insurance policy can be a daunting task. It’s important to understand your risks

Common Insurance Terms You Should Know

- Deductible – The amount of money you are responsible for paying before your insurance policy begins to cover the costs of a claim.

- Premium – The amount of money you pay to your insurance company in exchange for coverage. Premiums can be paid monthly, quarterly, or annually.

- Claim – A formal request made to an insurance company to receive payment for a loss or damage covered by your insurance policy.

- Underwriting – The process of evaluating and determining the level of risk associated with providing insurance coverage to an individual or business.

- Policy – The legal contract between you and your insurance company that outlines the terms and conditions of your coverage.

Understanding these common insurance terms can help you make informed decisions about your insurance coverage and ensure that you fully understand the details of your policy.

Common Insurance Myths Debunked

- Myth: If you have a good driving record, you don’t need car insurance.

Fact: Car insurance is required by law in most states, regardless of your driving record. It is important to have car insurance in case you are involved in an accident or your car is stolen or damaged.

- Myth: You only need life insurance if you are the primary breadwinner in your family.

Fact: Life insurance is important for anyone who has loved ones who depend on them financially, regardless of whether they are the primary breadwinner or not. If something were to happen to you, life insurance can help your family cover expenses like funeral costs and outstanding debts.

- Myth: You don’t need renters insurance if you don’t own a lot of expensive belongings.

Fact: Renters insurance covers more than just your personal belongings. It can also provide liability coverage in case someone is injured in your apartment, and can cover additional living expenses if you are forced to temporarily relocate due to damage to your apartment.

- Myth: Homeowners insurance covers all types of damage to your home.

Fact: Homeowners insurance typically covers damage from things like fires, storms, and theft, but may not cover damage from floods, earthquakes, or other natural disasters. It is important to carefully review your policy to understand what is and isn’t covered.

- Myth: If you have health insurance, you don’t need disability insurance.

Fact: Disability insurance can provide income replacement if you become unable to work due to an injury or illness, which is not covered by most health insurance policies. It is important to have disability insurance to help cover expenses and maintain financial stability in case of a disability.

By understanding these common insurance myths, you can make informed decisions about your insurance coverage and ensure that you have the right types and amounts of insurance to protect yourself and your family.

Conclusion

In conclusion, understanding the basics of insurance, as well as debunking common myths, is essential to ensuring that you have the right types and amounts of insurance coverage to protect yourself and your loved ones. It is important to carefully review your insurance policies and to ask questions to your insurance provider to fully understand your coverage and any potential limitations or exclusions. By doing so, you can have peace of mind knowing that you are protected in case of unexpected events or accidents.

FAQs

- What is the difference between a deductible and a premium? A deductible is the amount you are responsible for paying before your insurance policy begins to cover the costs of a claim, while a premium is the amount you pay to your insurance company in exchange for coverage.

- Why is car insurance required by law? Car insurance is required by law in most states to protect drivers and passengers in case of an accident. It also provides coverage for damage to property and can help cover the cost of lawsuits resulting from an accident.

- How do I know if I have enough life insurance? To determine if you have enough life insurance, consider your financial obligations, including outstanding debts, living expenses, and future expenses like education costs for your children. You may also want to consider consulting with a financial advisor to ensure that your coverage is sufficient.

- Is homeowners insurance required by law? Homeowners insurance is not required by law, but it may be required by your mortgage lender. Even if it is not required, it is highly recommended to protect your home and belongings from unexpected events like fires, storms, and theft.

- Can I change my insurance policy if my needs change? Yes, you can change your insurance policy if your needs change. It is important to review your policy regularly to ensure that it still meets your needs and to contact your insurance provider to make any necessary changes.

Katha Ankahee Watch All Episodes Free Video

Katha Ankahee Watch All Episodes Free Video